Simple, pragmatic & peaceful approach to Financial Planning

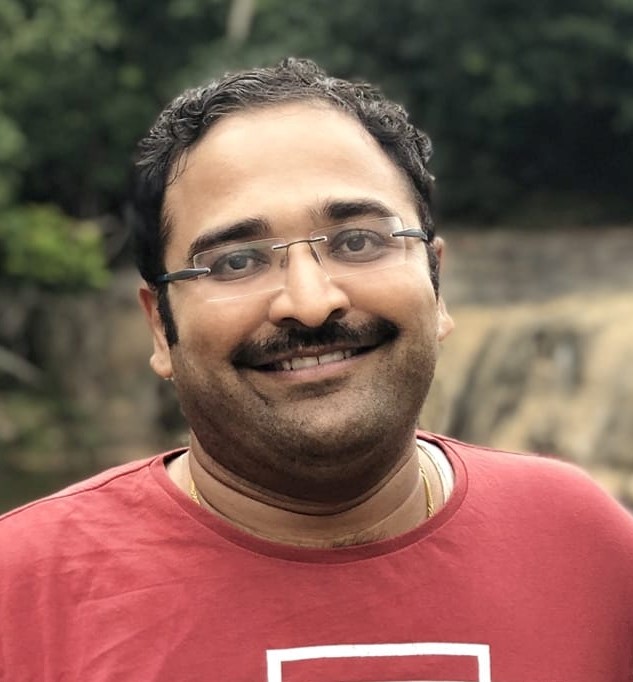

Welcome to VivekTaru. I am Swapnil Kendhe. I am a SEBI Registered Investment Adviser (RIA) and a Fixed-Fee Financial Planner.

Welcome to VivekTaru. I am Swapnil Kendhe. I am a SEBI Registered Investment Adviser (RIA) and a Fixed-Fee Financial Planner.

‘VivekTaru’ is a Marathi word meaning ‘The Wisdom Tree’. I chose this name for my website because everything boils down to wisdom in investing and money management.

I work on Education + Financial Planning model. I believe that my primary job as a financial planner is to educate my clients about the basics, principles, and practicalities of money management; so that they become capable of managing their money on their own.

I help my clients set their financial house in order and align their savings and investments with their financial goals and aspirations.

I follow the Defensive-Passive approach of investing as described by Benjamin Graham in his investment classic ‘The Intelligent Investor’. In this approach, we construct permanent portfolios which can majorly run on autopilot and require little further effort. The emphasis is on avoiding serious mistakes or losses and to be free from effort, annoyance, and the need for making frequent decisions.

I give advice based on the understanding that financial planning is all about the future and the future is unpredictable. There could be lucky as well as unlucky outcomes in the future. I believe that the financial plan should withstand and survive unlucky outcomes; not just rely on lucky outcomes.

After spending over twelve years studying and exploring personal finance and investing, I have realized that outcomes are not in investor’s or adviser’s control. No investor or adviser can find the best-performing fund of the future unless he/she is lucky. The role of an adviser is to help his clients focus on the process, follow time-tested principles and practicalities of investing, and avoid common investing pitfalls, since it leads to much better outcomes than focusing only on return.

I keep things simple in life and in financial planning. I do not recommend complicated financial products. Simple is more sophisticated in financial planning.

If you are looking for an unbiased, simple, pragmatic, and peaceful approach to financial planning, and if you want to learn to become a capable DIY (Do It Yourself) investor, you have arrived at the right place.

For my background,

you can check this guest article published in freefincal.com on March 22, 2018 – Fee-only advisor journey: Swapnil Kendhe’s successful transition into a SEBI RIA

In June 2020, Pattabiraman Murari of freefincal.com asked me write another article describing my journey as a fee-only financial planner till then. Here is a link to the article – Becoming a competent & effective financial advisor: My journey so far

Fixed-Fee

“Fixed-Fee” means I charge a flat fee for the advice, based on the amount of effort involved, not linked with assets of the client.

No Commissions

I receive no commissions or incentives directly or indirectly from mutual fund houses, insurance companies, and other financial product manufacturers. Clients pay me a fee for the advice and invest in commission-free financial products like direct plans of mutual funds.

No Conflicts

The “Fixed-Fee” eliminates the conflict of interest involved in commission-based advice and AUA-Fee (Assets under Advice) advice. This helps me provide unbiased, objective, and comprehensive financial advice.

Fiduciary

As a SEBI registered investment adviser, I have the fiduciary responsibility to serve my clients. Meaning, I have to put my client’s interest above my own.

Experienced

Over 13-years experience in financial advisory. Cumulatively engaged with over 600 client families.